Managing personal finances can be challenging, but with the right apps, staying on top of your expenses, savings, and investments becomes much easier. These apps help you track spending, set budgets, and plan for your financial future. Here are the Top 5 personal finance and budgeting apps to make your money work better for you.

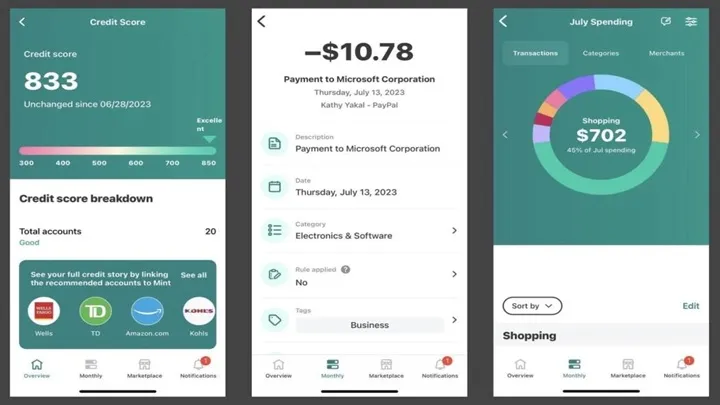

1. Mint

Mint is one of the most widely used budgeting apps with an intuitive interface.

Key Features:

- Automatic expense tracking by linking bank accounts.

- Budget creation and bill reminders.

- Credit score monitoring and financial insights.

Perfect for anyone wanting an all-in-one view of their finances.

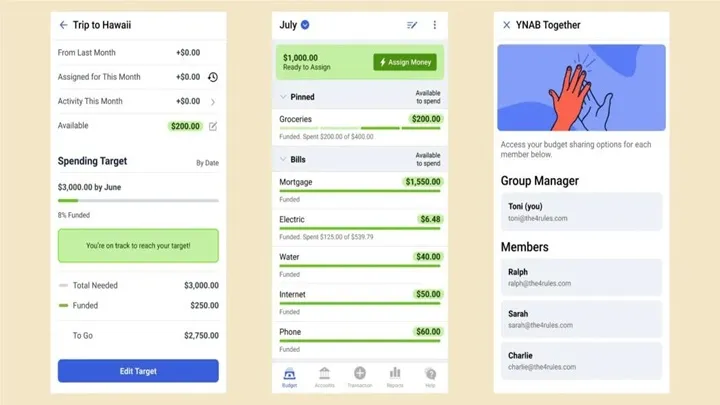

2. YNAB (You Need a Budget)

YNAB is designed for proactive money management and goal setting.

Highlights:

- Envelope-style budgeting system.

- Real-time syncing across multiple devices.

- Detailed spending and debt payoff analysis.

Ideal for people who want to plan every dollar with purpose.

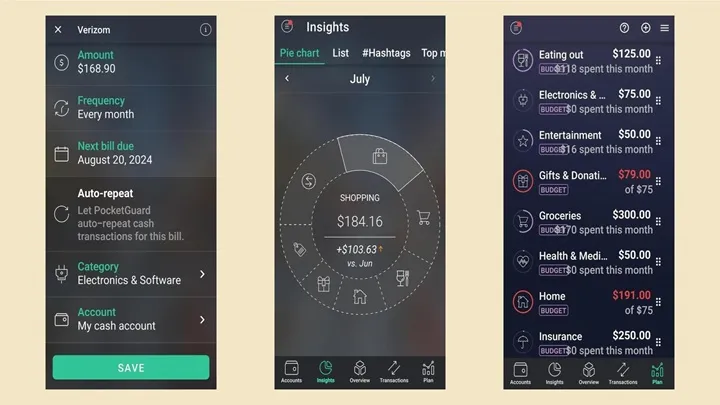

3. PocketGuard

PocketGuard simplifies budgeting by showing how much you can safely spend.

Why It Stands Out:

- Automatic categorization of income and expenses.

- “In My Pocket” feature for available spending.

- Bill tracking and savings goals.

Great for beginners who want to avoid overspending effortlessly.

4. Goodbudget

Goodbudget is a modern take on the envelope budgeting system.

Key Features:

- Manual input for better financial awareness.

- Sync across devices for couples and families.

- Expense history reports for tracking habits.

Perfect for people who like to plan together and stay disciplined.

5. Personal Capital

Personal Capital combines budgeting with wealth management.

Why Users Love It:

- Tracks both spending and investments.

- Retirement and net worth planning tools.

- Visual dashboards for financial health.

Ideal for individuals who want to go beyond simple budgeting.

Why These Apps Are Essential

These apps are designed to make managing your money less stressful and more efficient. Whether you want to cut unnecessary expenses, save for a goal, or grow your wealth, the right app can be your financial assistant in your pocket.