Managing your money wisely is crucial, whether you're a student, professional, or business owner. These apps help you track spending, save more, and plan better financially.

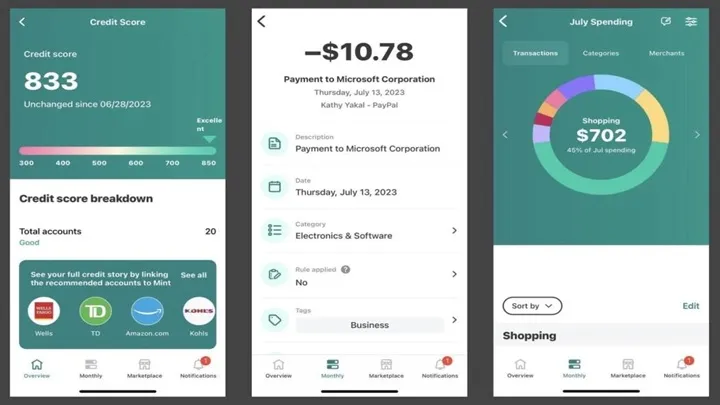

1. Mint

A popular budgeting app that helps you see all your finances in one place.

Key Features:

- Automatic expense categorization.

- Bill reminders and alerts.

- Insights into your spending habits.

Great for people who want a simple overview of their budget.

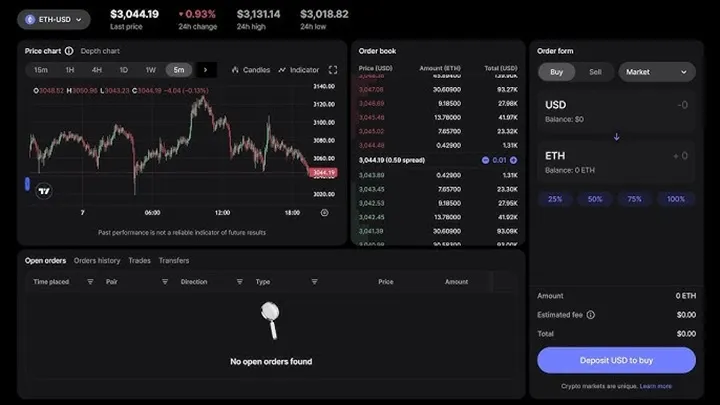

2. Revolut

A modern banking and finance app for global users.

Highlights:

- Multi-currency accounts.

- Real-time spending analytics.

- Cryptocurrency and stock trading options.

Ideal for travelers and freelancers.

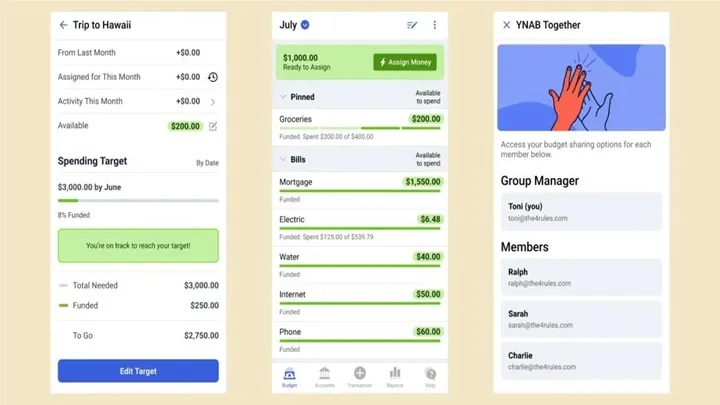

3. YNAB (You Need A Budget)

Focused on giving every dollar a job.

Why It Stands Out:

- Proactive budgeting system.

- Helps reduce debt and increase savings.

- Goal tracking with financial education.

Perfect for those serious about financial discipline.

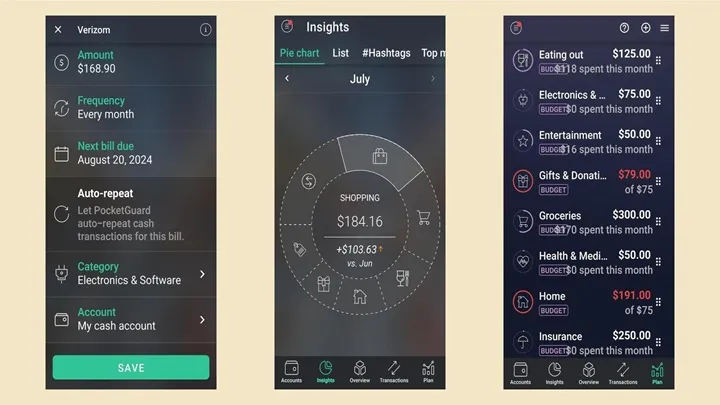

4. PocketGuard

A simple app to stop overspending.

Key Features:

- Tells you how much “safe-to-spend” money you have.

- Tracks bills, subscriptions, and recurring payments.

- User-friendly interface for beginners.

5. Goodbudget

A modern take on the classic envelope budgeting method.

Why People Like It:

- Syncs across multiple devices.

- Helps couples and families manage money together.

- Easy-to-understand visual reports.

Why These Apps Matter

These finance apps simplify budgeting, saving, and planning — making financial wellness achievable for everyone.